3 Easy Facts About Pr Africa ExplainedTable of ContentsWhat Does Pr Africa Mean?The Buzz on Pr AfricaPr Africa Can Be Fun For EveryonePr Africa Fundamentals ExplainedAll About Pr AfricaThe 25-Second Trick For Pr AfricaRather, placed the word "more" at the bottom facility of the initial page to suggest to the viewers that there is even more content

South African Culture Today Things To Know Before You Buy

The 10-Minute Rule for South African Culture TodayTable of ContentsAbout South African Culture TodayThe 45-Second Trick For South African Culture TodayGetting The South African Culture Today To WorkFacts About South African Culture Today UncoveredSouth African Culture Today Things To Know Before You BuyThe Definitive Guide for South African Culture

3 Simple Techniques For Breaking News

How Breaking News can Save You Time, Stress, and Money.Table of ContentsBreaking News - The Facts3 Easy Facts About Breaking News ShownAbout Breaking NewsUnknown Facts About Breaking NewsIndicators on Breaking News You Need To KnowHowever, when it pertains to news and info, we understand that authoritativeness is essential. That's why we're devoted

News Articles - Questions

The 20-Second Trick For News ArticlesTable of ContentsNews Articles Things To Know Before You BuyFacts About News Articles UncoveredSome Known Facts About News Articles.The Only Guide for News ArticlesMore About News Articles, one tough choice to make is where to focus insurance coverage and resources. This research study asked Americans regarding

The Single Strategy To Use For International News Online

7 Simple Techniques For International News OnlineTable of ContentsThe 9-Minute Rule for International News OnlineOur International News Online Ideas4 Simple Techniques For International News OnlineInternational News Online Fundamentals ExplainedMore About International News OnlineOther variables responsibility, dependability and resources would cer

Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Lark Voorhies Then & Now!

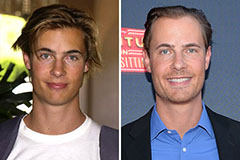

Lark Voorhies Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!